Context:

The term “like” (from English Hold on to an expensive life), Links in the crypto sector to maintain their digital assets for a long time, regardless of the vagaries of the market. Hralery is therefore long -term holders who keep their works at all costs.

Despite some attempts to increase, the price of the BTC remained stagnated, which increases pressure on the long -term holder (LTH) or the Bitcoin holder. These investors who once used solid benefits now see a reduction in their unrealized profits.

Bitcoin investors will download

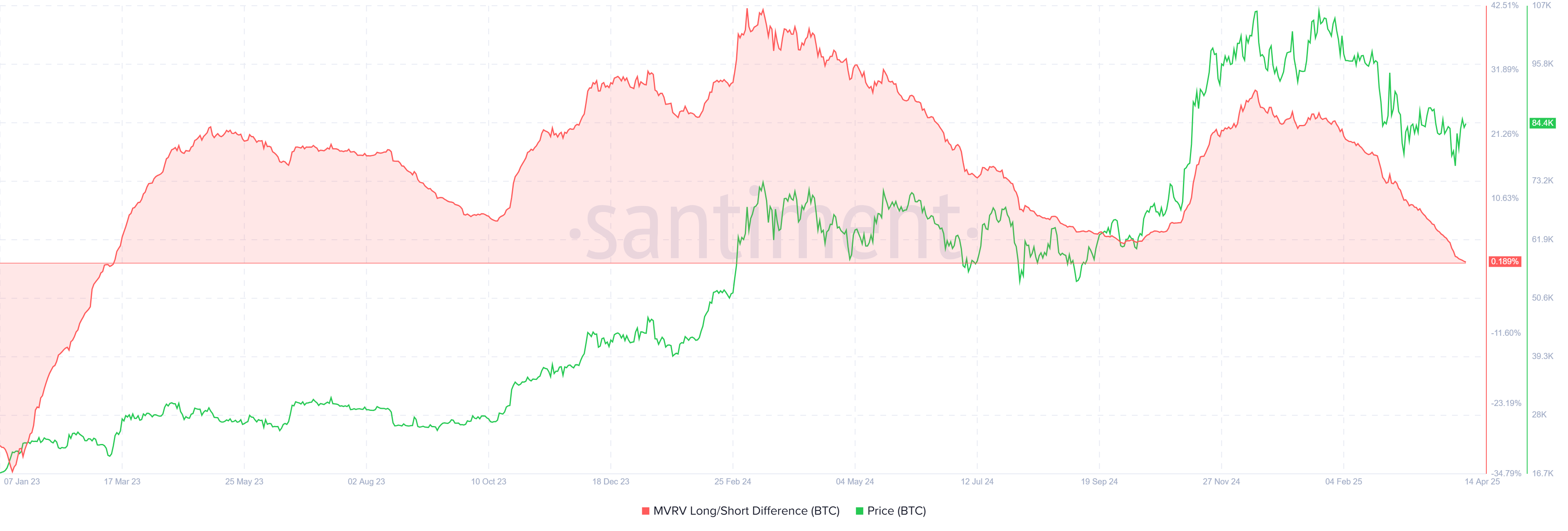

The difference in a long/short MVRV, a key indicator used to assess the market feeling, reveals a worrying trend for some bitcoins holders. The indicator has recently reached a two -year cavity, suggesting that the profits of long -term holders have been at the lowest level since March 2023. This change suggests that market conditions are increasingly unfavorable to LTH.

Thus, while the Bitcoins course straightens, short -term holders (STH) begin to dominate, using prices. Meanwhile, long -term holders (LTH) faced profits down, hesitate to buy or keep more.

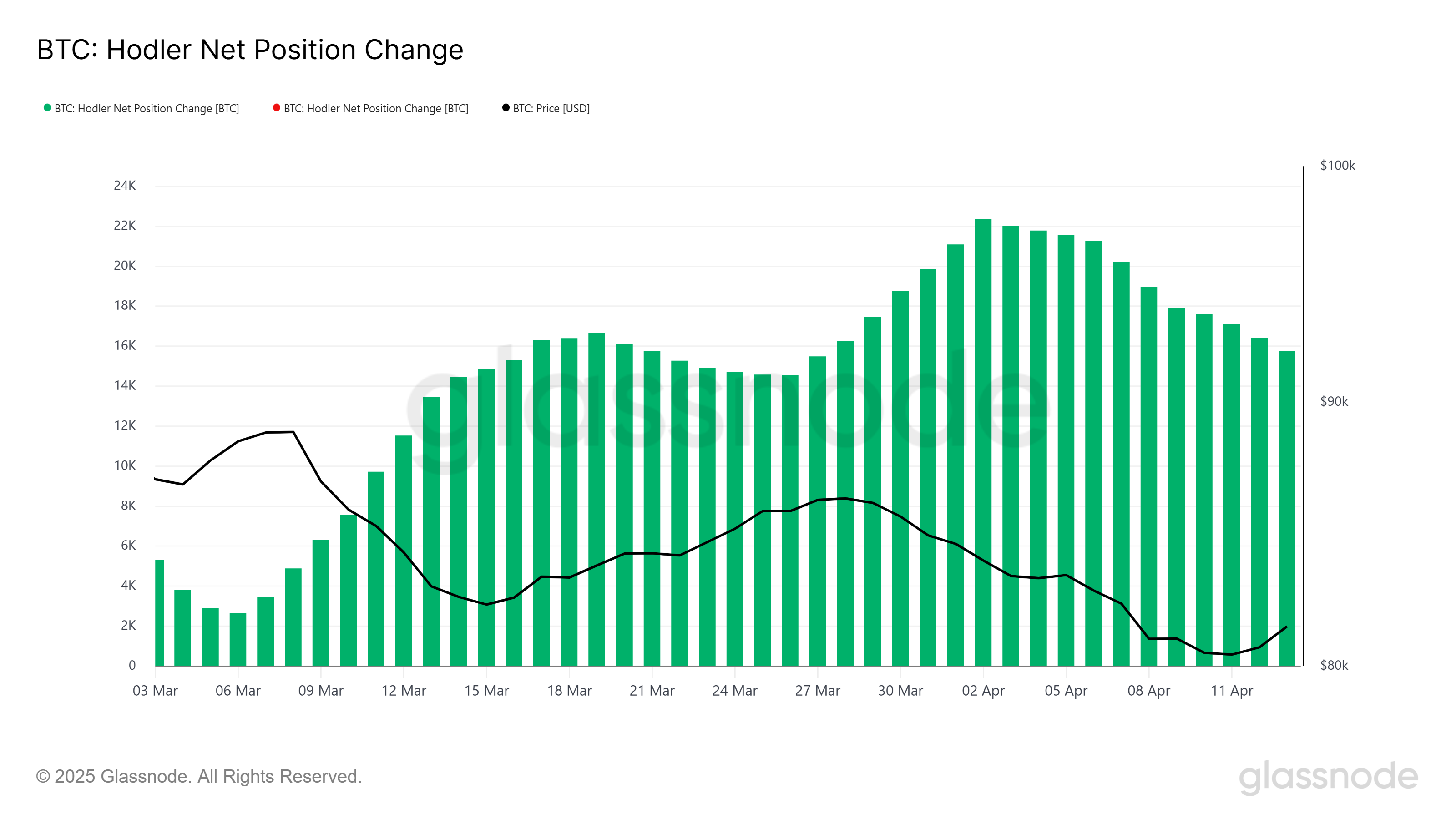

The total bitcoin ride, measured by technical indicators, also reflects reduced signals. Changing the pure position of Bitcoin Hralers strengthens this story because it shows that LTH has sold a significant part of their assets in the last two weeks. Overall, these sales have reached more than 6,596 BTC, which is more than $ 550 million.

Although this character may not seem huge, the psychological passage of trust in the caution between LTH is a source of concern. This lack of beliefs could postpone the restoration of bitcoins and contribute to prolonged stagnation of the course, which in turn could reduce market activity and worsen the current decline.

Bitcoin course is trying to recover

Bitcoin is currently negotiated to $ 84,421, it is now just above the key support level of $ 82,619. The price remains trapped below the key resistance level of $ 85,000, which could cause further pressure if it cannot exceed it. If the asset loses support to $ 82,619, it is possible to decline to further main psychological support of $ 80,000.

If the trend of descents continues, the price could reduce more, the 78,841 USD has appeared as a critical level for monitoring. Indeed, the loss of this support would mean a significant decline, which would confirm continuously the market weakness and deepening the reduction of Bitcoin perspectives.

However, if the BTC finally exceeds and maintains a mark of $ 85,000 as support, it could cause recovery and move the price to $ 86,848. A permanent increase above $ 85,000 would then cancel the current declining trend and opened the way for a possible climb to $ 89,800 and restored the confidence among Bitcoin investors.

History Morality: Bitcoin Hodlers are afraid of more than a stagnation course.

Notification of irresponsibility

Notice of non -response: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.